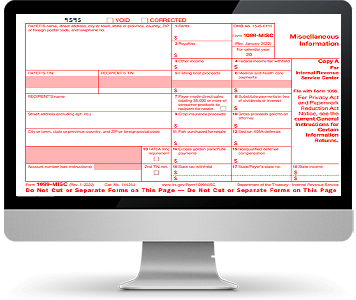

What is Form 1099-NEC?

The IRS has introduced a new form for reporting nonemployee compensations. Payers who have made $600 or more to nonemployees and independent contractors as compensation during a tax year must file Form 1099-NEC. Payers will also have to send recipient copies within the deadline.

Visit

https://www.taxbandits.com/1099-forms/what-is-form-1099-nec/ to know more about

Form 1099-NEC.

Benefits of Filing Form 1099-NEC Online

Access the best benefits and E-filing 1099 Forms easily by choosing us as your filing partner. Below are some of the benefits you will get when you choose to file your Form 1099-NEC online.

Instant Filing Status

Get notified as soon as your

return is processed.

Form

Validation

Make sure your return is

error-free

before transmitting.

Mail Recipient Copies

Opt to mail employee copies

on your behalf.

Lowest

Price

File 1099-NEC for the lowest price of

($0.80/form).

Form 1096 for Free

Get Form 1096 for free when you file

1099-NEC online.

Download or Print Forms

Download or print forms anytime

and anywhere.

How to File Form 1099-NEC Online for 2022 Tax Year?

File Form 1099-NEC online by following a few simple steps. It will take only a few minutes to complete the filing process. Below are the steps

that need to be followed:

Fill Out

Form 1099-NEC

Enter the Form 1099-NEC information as you would fill out a physical form. Make sure you have all the required information before

starting to file.

Review Your

Form 1099-NEC

Preview the draft form and make sure you’ve entered the correct information. Our

in-built audit check will also prompt you to correct any errors.

Transmit

Form 1099-NEC to IRS

After review, transmit the return directly to the IRS. You will receive an email once your return is processed

by the IRS.

Form 1099-NEC must be filed every year on or before January 31st. Also, the recipient copies should be furnished before the deadline. If the due date falls on a weekend or federal holiday, the returns can be filed on the next business day.

For the 2022 tax year, the

due date to file Form 1099-NEC is January 31, 2023.

Penalties for not filing

Form 1099-NEC on time

If you miss filing Form 1099-NEC or furnishing recipient copies before the deadline, there will be penalties. The 1099-NEC penalties will vary based on the date the return has been filed. If you file Form 1099-NEC within 30 days after the deadline, there will be a penalty of $50/form. The penalty will increase to $110/form for the returns filed after 30 days but before August 1. It will also increase up to $280/form for the forms filed after August 1.

Other Supported Forms

- Form 1099-MISC, Form 1099-K, INT, DIV, R, S, G, C, B, PATR & other 1099 Form

- Form 1095-B/C, 941-PR, 941-SS

- Form W2, W-2c, W-2PR, W-3

- Form 941, 941-PR, 941-SS

- Form 990-N, 990-EZ, 990, 990-PF & 1120-POL

- Form 8868, Form 8809

Form 1099-NEC Filing Pricing

E-file Form 1099-NEC for the lowest price in the industry! Pay just $0.80 to e-file a return and get Form 1099-NEC for free. You also have an option to mail recipient copies. Below is the pricing details:

| E-Filing Fee | Mail Recipient Copies (Optional) | Form 1096 |

|---|---|---|

| $2.75/form | $1.50/form | FREE |

| E-Filing Fee | Mail Employee Copies (Optional) | Form 1096 |

|---|---|---|

| $2.75/form | $1.50/form | FREE |

Frequently Asked Questions on Form 1099-NEC

Contact Us

Have questions regarding Form 1099 NEC Online Filing? Contact us at support@taxbandits.com